IFRS 16 is the International Accounting Standards Board (IASB)'s new accounting standards to cover how businesses report their lease agreements. All leases will be included on balance sheet, with some possible exemptions for short-term leases and small ticket valued items. IFRS 16 will replace IAS 17 and comes into effect on 1st January 2019.

This page is filled with all sorts of helpful advice to make sure you and your business understand everything there is to know about IFRS 16.

Here's a one-stop resource for all the most useful and easy to use IFRS 16 related content you'll need. The content headings in the table of contents to the right of the page contain hyperlinks which will jump to the relevant section. Press the one which is most relevant to you and you will find an introduction to that specific topic, as well as a host of other resources and deeper-dive reads therein.

If you find this page useful, bookmark it, share it or save it for future use. Or get in touch and see how else we can help you with understanding and preparing for IFRS 16.

To get back to this section, press 'Back to Top' at any point.

IFRS 16 is the International Accounting Standards Board (IASB)'s new accounting standards to cover how businesses report their lease agreements.

All leases will be included on balance sheet, with some possible exemptions for short-term leases and small ticket valued items. IFRS 16 will replace IAS 17 and comes into effect on 1st January 2019.

Jump to 'Why IFRS 16 Is Happening' by clicking here.

All companies that lease assets will be affected. If you do not comply with IASB standards but comply with Financial Accounting Standards Board (FASB) practices instead, your equivalent standards change is Topic 842. You can jump to 'A Word On FASB Topic 842' by clicking here.

It's estimated that half of all listed companies will be affected, and the ever-growing popularity of leasing suggests this ratio will grow.

The financial representation of your business to investors, board members and potential buyers will all be affected indirectly as will credit lines. This is because IFRS 16 has a direct impact on: your balance sheet; gearing and current ratios; asset turnover; interest cover; EBIT and EBITDA; operating profit and net income; EPS ROCE and ROE; and operating cash flows.

To gain a better understanding of what financial metrics will be impacted by the introduction of IFRS 16, here is a useful article that explores the headline financial metrics affected.

It is estimated that US$2.8 Trillion of lease commitments will come onto balance sheets around the world, which will impact assets, liabilities, depreciation and cash flow. This signifies the scale of the changes at hand.

The deadline for implementation is 1st January 2019 but retrospective reporting is required, and early adoption may be an option when used alongside IFRS 15 'Revenue From Contracts With Customer'. In order to meet the deadline, ready your portfolio, collate and collect the necessary data, update the relevant parties, and then achieve compliance, work should have begun in early 2017 at the latest.

Take a look at this free download for you to share around your business and help educate your colleagues on IFRS 16 in brief.

Topic 842 will be replacing FAS 13/Topic 840. It's the FASB's equivalent of IFRS 16 and their own new standards to help realign lease accountancy and reporting with modern day leasing habits. The changes are broadly similar to IFRS 16, but the biggest headline difference is that the implementation deadline and options are different. These are:

If you follow FASB standardised practice, then here is a useful download to help you understand Topic 842 further.

From the implementation date and changes to the definition of a lease, to what will be replaced. Here are some of the main changes you'll encounter as a result of the new lease accounting standards:

IFRS 16 states a lease as: 'a contract, or part of a contact, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration.' A lease exists when a customer controls the right to use an identified item, which is when the customer:

It's expected that agreements that were formerly considered leases under IAS 17 may no longer meet the IFRS 16 specification and vice versa.

Now that all leases will be accounted for "on balance sheet", operating leases will, in effect, cease to exist. At least, that is to say, lease agreements will no longer be classified as an operating lease as they currently are under IAS 17. Instead of being based on risk and reward, the classification of a lease will focus on control of the right of use of an asset; namely the difference between a lease and a service.

Although in principle, the definition of a lease in IFRS 16 is similar to under IAS 17, there is more detail regarding the classification of a lease.

IFRS 16 contains new guidelines towards the definition of a lease that differs from the current definition features in IAS 17 and IFRIC 4. This is to provide further clarity between the classification of a lease agreement and other agreements, such as a service contract.

A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. A contract can qualify as a lease or as containing a lease if:

IFRS 16 only affects leases; if an agreement does not contain a lease, then there is no need to recognise the arising 'assets' and liabilities on balance sheet. A different accounting standard would apply instead.

Here's a handy webcast on the definition of a lease from IFRS.org (link opens in new window).

When it comes to being able to truly understand what constitutes a lease under IFRS 16 and ensure you don't accidentally breach compliance, you can speak to a leasing expert or use this free explanatory guide. The e-Paper aims to provide a detailed overview of the new definition of a lease, its associated implications and provides practical advice on how businesses are able to navigate the changes of IFRS 16.

The ubiquitous quip by, then IASB Chairman, Sir David Tweedie that one of his "great ambitions before [he] die[s] is to fly in an aircraft that is on an airline's balance sheet" perfectly captures the scale of the disconnect between accounting standards and how much is spent on lease agreements and how much companies can use now-outdated standards to their financial advantage.

The fact that an airline company can lease the asset their whole service depends on, a passenger jet, and charge their customers to use it but the asset in question doesn't have to be accounted for on balance sheet is, frankly, ludicrous. It's a wonder that IFRS 16 didn't happen sooner. But this may suggest that airline companies are the sole reason for the change and that isn't the case.

Retailers, construction companies, hauliers and logistics experts are all just as culpable. It's natural for businesses, and in particular accountants and accounts departments, to file their finances in the most efficient and financially beneficial fashion. Why wouldn't you? The growth of the leasing market and the favourable reporting standards created the perfect storm.

And IFRS 16 is designed to bring standards up to speed.

The new standards are designed to bring greater clarity and comparability of companies' financial statements by recognising all assets and liabilities arising from leases by reporting them on company balance sheets. At the moment, current IAS 17 standard practice does not prescribe operating leases to feature 'on balance sheet'. This means investors and would-be buyers often over-estimate financial realities of a company which has a large operating lease portfolio by perhaps underestimating its unstated liabilities.

Here's an interesting interview with Tweedie, by Andrew Sawers, on Financial Director which you may enjoy.

It may be the case that you and your business are new to the practice of leasing and wondering whether IFRS 16 will mean that you should altogether forget leasing as a means of acquiring your assets. It may also be the case that you're wondering whether your comparatively modest leased asset portfolio - clearly, not every business will lease on a level with British Airways - is big enough for IFRS 16 to be an issue.

It will. And there are pros and cons of leasing in light of IFRS 16 which you will need to consider. For example, you will still be able to take advantage of the general benefits of leasing compared to purchasing assets outright. Cash flow will be more predictive and easier to forecast, there will be no capital sucking assets on your books at the end of their useful life under your stewardship, and full ownership maintenance costs won't necessarily be your concern.

On the other hand, IFRS 16 will change the way you have to report any lease agreement, such as all and any of them being brought on balance sheet and this in turn will impact your ease of achieving accounting compliance.

No matter the size of your lease portfolio, inadvertently missing out on IASB compliance could have some severe implications. The time is coming where you not only need to make sure your lease portfolio is properly accounted for, but it's going to be so important to your financial success that you will need to consider investing in lease accounting software to assist with your compliance efforts.

If you're thinking this might be the case, here's a helpful blog post with three signs that it's time for an automated piece of lease accounting software.

Increasing transparency and allowing easier comparability is the aim of the new standards, but in achieving this, there are new challenges that businesses are facing. Primarily, a full valuation of your lease portfolio needs to take place, and here we highlight some of the challenges you're now up against:

For further explanations on this topic, PKF Littlejohn LLP has produced a thorough look at what IFRS 16 means for you and your clients. Also, on a related theme, you might find these posts useful too: How To Make The Lease Accounting Data Collation Process A Success, How Will IFRS 16 Impact Business KPIs and Financial Performance Metrics? and Which Transition Method Should I Use? The Pros And Cons Of Each Method.

Organisation, proper prior planning and structured communication are the three core elements to achieving lease accounting compliance. The larger your lease portfolio, the larger the task at hand and the earlier preparatory work should begin. Or, rather, should have begun. With the implementation deadline of 1st January 2019 creeping ever closer and your business possibly benefiting from early adoption, work if not begun now starts with getting organised.

Compliance with the new standards can be achieved by tackling the process in seven distinct steps.

Wondering how to get buy-in from your accounts department? Read this.

If those 7 steps raised a few more questions or made you think of a few potential exposure points when achieving compliance, take a look at this deep dive document. The 7 Steps to Lease Accounting Compliance eBook is a thorough and easy to understand, designed to give you a full overview of the standards and a practical explanation of the implications. It also outlines the seven steps to compliance, above, in full detail, with extra guidance on each step.

It's a great resource for furthering your own understanding and helping to illustrate to colleagues or bosses why leasing changes do, in fact, impact your business.

They already have. And this statement is not as flippant as it first sounds because you've already searched out explanations on the topic, but because it's typical that preparation for compliance can take up to two years.

In the first instance, the magnitude and number of changes which are required in order to get ready for IFRS 16 mean that it simply takes time and resource to prepare. Besides the whole host of knock-on impacts from the changes, such as the effect that IFRS 16 will have on key financial metrics, the biggest single change is that operating leases will, as a result of the new standards, effectively cease to exist as a separate category for accounting purposes.

These changes mean that all leases will now be represented on balance sheet. To illustrate, an estimated US$2.8 Trillion is expected to drop onto balance sheet reports and this change must impact profit and loss accordingly.

Furthermore, the definition of what actually constitutes a lease and what constitutes a service agreement is changing, and vice versa. What this means to you is that your company will need to gather and assess all the related agreements and associated paperwork in order to begin ensuring compliance is achieved in time for the deadline.

And the second broadly-complicating reason for the early need to prepare for IFRS 16 is that there are possible exemptions, early adoption and required retrospective reports that need consideration.

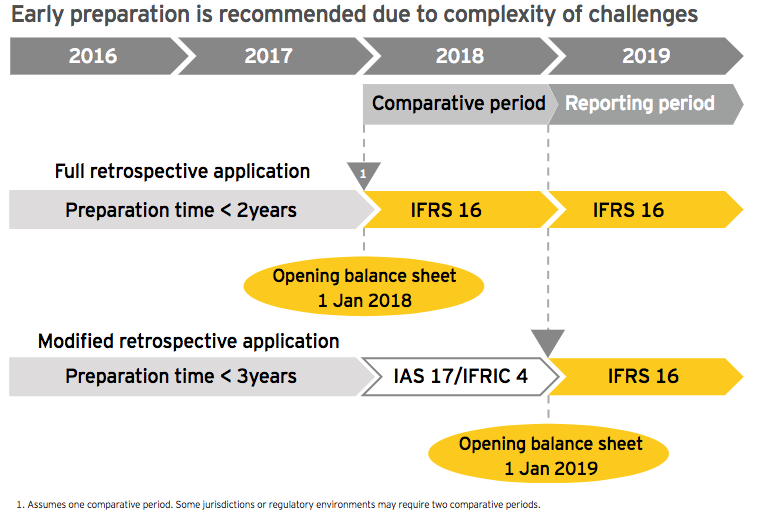

Ernst & Young advise in their ePaper on the topic, Leases - A summary of IFRS 16 and its effects, that with reporting for IFRS 16 beginning on 1st January 2019 at the latest, assuming a modified retrospective application is employed, the latest preparation should begin is during 2016. The level of complexity in understanding the new standards, gathering all the data required in order to fully assess the situation and then creating the proper reports are just three headline factors which make compliance such a long process.

Extract from Ernst & Young's paper on IFRS 16.

Compliance is no quick fix. It's complex and also unlikely that the team dedicated to achieving compliance will have the task as their sole focus. At best, it's going to detract from their ordinary responsibilities and at worst it will have direct financial implications if left non-compliant.

These factors hint at some of the secondary impacts of IFRS 16. Read about the subject further here and on the rest of our blog and subscribe for updates.

The impact of the new standard will differ on a company by company and industry by industry basis, dependent upon factors such as the size of an entity’s leasing portfolio, internal processes and reporting structures or the demands of the industry.

Some industries will be more likely to be impacted by lease accounting changes. As mentioned, the aviation industry is an example which grabs the headlines due to the unlikely nature of Acme Passenger Airways' passenger planes not being shown on balance sheets as an operating cost, but other sectors are facing a bigger task.

The retail industry and courier or haulier companies, for example, are two which rely heavily on leased property and assets in order to stay agile and keep overheads low, whilst accessing the most current equipment. Leasing is vital to how certain sectors function.

We have already produced a range of resources to help particular industries in particular. Just head to the page from the list below which applies to your business' industry or sector.

As mentioned above, Excel and other similar spreadsheet programs aren't suitable for or capable of managing a full lease portfolio. Not when IFRS 16 demands closer scrutiny, readier access to information and the ability to quickly compile reports compared to how you operate currently.

If you think that you might be ready for an automated accounting software tool, but aren't sure, here are three reasons from one of our blog posts:

The benefits of lease management and accounting are myriad and using the right software cannot only make compliance with the new accounting standards easier but will also help to ensure your lease portfolio is managed in an improved and beneficial way. Your lease portfolio could perform better than before the change if you use the right tools.

Make sure that you tap truly into the benefits of the best lease management software by choosing a programme which facilitates all of the following:

Read the full explanation on these points in our blog post 'Why Are Companies Investing In Lease Management Software?' and then see more benefits from digitising your lease management in this free download.

The ultimate outcome is a stronger bottom line.

Add into this mix an insight into wider leasing market trends and expert advice, and you've got somebody - or something - on your team who will help you turn IFRS 16 into an opportunity rather than a threat.

Innervision's lease accounting solution, LOIS - Lease Accounting, is the most advanced application available on the market and supports both lease accounting standards, IFRS 16 and FASB ASC 842, as well as existing IAS 17. The system allows users to account for and manage all lease asset types, ranging from IT, plant and machinery to material handling equipment, vehicles and property.

For a detailed look at some of the key features of Innervision's lease accounting software, you can access the LOIS product brochure here.

Find out more by speaking to a lease accounting expert here at Innervision or by requesting a demo of the LOIS software.

Disclaimer: this article contains general information about the new lease accounting standards only, and should NOT be viewed in any way as professional advice or service. The Publisher will not be responsible for any losses or damages of any kind incurred by the reader whether directly or indirectly arising from the use of the information found within this article.

The advice, checklist and approach outlined in this e-Book will provide you with everything you need to know about creating an effective transition strategy for your company.